News & Views aka The Blog

Registered Users may post comments to the Blog (just sign in and we'll set you up)

Week 3: dacorta criminal trial - May 2-4/2022

May 11, 2022

Monday 5/2

Following up on his opening testimony from Friday, 4/29, Mike DaCorta responded to important questions regarding the prior confused testimony of the government’s witness from Thursday last regarding his Ntl. Futures Assoc. (NFA) settlement agreement and explained why spread earnings are, in fact, revenue – contrary to what the former NFA employee “expert” had stated on 4/28.

Membership in the NFA is voluntary unless a trader needs to be registered with the CFTC. Mike did NOT have to be registered with the CFTC because he ONLY traded the Company account. The companies, OM and OIG, were eligible contract participants (“ECP’s”) as defined in 7 U.S.C. § 1a(18)(A)(v)(III)((aa)-(bb)), thus Mike did not need to register with the CFTC nor be a member of the NFA. None-the-less, the Prosecution hammered on his standing with the NFA subsequent to his settlement agreement. Given the complexity of the statute and the constant belaboring of their illegitimate argument, the jury was probably left with the impression that Mike had been barred from trading.

To rebut the argument that spreads were not revenue just because a profit wasn’t realized from them, Mike used the example of a furniture store owner who purchased a living room couch ensemble for $3,000 wholesale. The owner then promised the party who had loaned him the money to make the purchase that they would be paid $400 whenever the ensemble sold. He placed the furniture on sale for $4,000 but received no offers. After a couple months with no buyer interest, he reduced the price to $3,000; the price he’d paid for it. Still nothing, he further cut the sale price to $2,000, whereupon it was purchased. He entered that sum into his account as revenue, but he still had the promised obligation to pay his lender the agreed-upon $400. That left only $1,600 net from the ensemble he’d paid $3,000 for, but it’s still booked and accounted for as revenue, just as the spread earnings are revenue regardless of the consequences of the trade that followed directly from them being earned. The government has previously acknowledged that Oasis earned $52 million in spread earnings, also known as “transaction fees”.

Every Forex trade involves two traders (a buyer and a seller) and requires each of them to pay a “spread” fee in order to enter their trade. It’s no different than if you pay a $20 cover charge at nightclub door. That money belongs to the nightclub owner, regardless of what happens to you once you enter the place. You might have the time of your life (as in a great Forex trade win), or you might get rolled at the bar (as in losing a Forex trade), but either way the $20 door charge remains as revenue for the club. Just so, the spread fees earned in trading belonged to Oasis and the “expert” was wrong in refusing to identify them ($52 million worth) as revenue for the Company.

Another example that just about everyone has experienced… you buy a ticket to watch a movie. You may or may not enjoy the movie you paid for, but there isn’t a refund regardless. The ticket price is kept by the movie theatre and a portion of it is paid to the distributor who licensed the movie.

On cross examination, Frank Murray for the prosecution brought up various purchases that Mike had made, including the Maserati and a Land Rover Evoque for his daughter. Mike was able to point out that neither car was purchased with Oasis funds and both had 7-year car loans on them. What didn’t get put on the record was that upon seizing the two cars, the Receiver notified the banks that the loans would not be paid, so the banks had to write them off as losses, and then the Receiver “abandoned” both cars rather than sell them as assets of the Receivership Estate. They are now being driven around by Lord only know whom. We have no idea if they were sold or just given away, but no credit for either of them was added to the balance of payments potentially for the benefit of the Lenders or for Oasis should Mike be acquitted, and the civil case dismissed.

Again, on cross, Mike’s daughter’s tuition was brought up by the Prosecution, which allowed Mike to explain that he had paid room and board for his daughter, that she earned scholarships and incurred an education debt of $20,000 for the part of her tuition not otherwise covered.

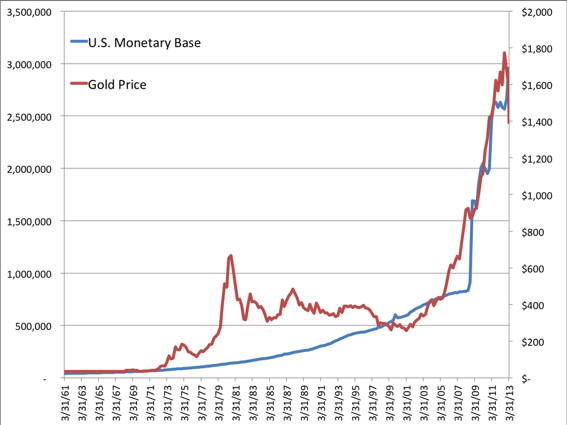

Asked why he bought gold and silver, Mike explained that on October 4th, 2018, the government had lost over $20 trillion in unaccounted funds, so under the Federal Accounting Standards Advisory Board (FASAB) Standard 56 (http://files.fasab.gov/pdffiles/handbook_sffas_56.pdf) it gave itself permission, as Catherine Austin-Fitts explains, “[to] create a set of situations where government entities may move numbers around to conceal where money is actually spent or even not report spending outright.” (See https://constitution.solari.com/fasab-statement-56-understanding-new-government-financial-accounting-loopholes/).

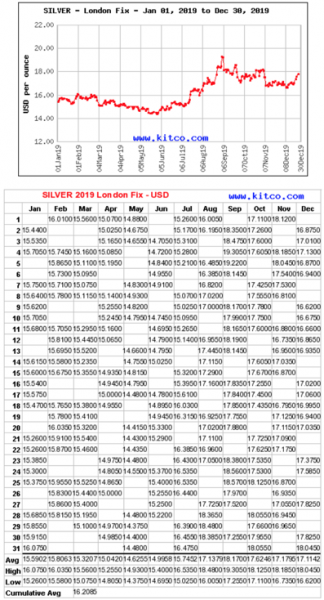

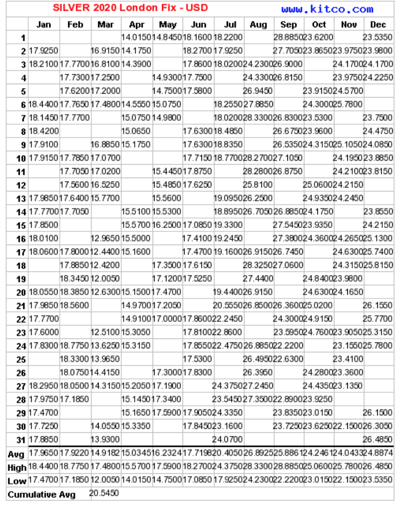

Mike explained that this new standard signaled the United States dollar was on the way to losing its global reserve status (established at Bretton Woods, New Hampshire in 1944-45). That being said, both silver and gold are well positioned to increase in value as the U.S.D. steadily diminishes… and that’s exactly what has happened since Mike purchased the precious metals and opened a 3.8M ounce silver position vs the USD on the Forex trading platform. If the dollar’s purchasing power declines, as will happen if the government keeps printing more of them, then silver’s price will rise.

His own financial expert later confirmed that by September of 2019 the gains in that one position alone would have produced enough profit for Oasis to cover ALL of its outstanding debts–but the Receiver prematurely closed the position at a $3.5M loss instead.

By early autumn 2020, the silver Forex position alone would have earned $60M in profits.

Mike explained that once the debts were covered by his trading position, he would have taken part of the position off the market, paid the debts off and continued from there. Exactly as any good trader would have done.

We’re sure the Prosecution regretted challenging Mike with financial questions, like asking why he hadn’t just deposited funds in a safety deposit box, to which he answered that under the Obama administration’s changed rules and regulations, deposited monies become property of the bank.

Failing to learn from that telling response, the Prosecutor asked him about Social Security and Medicare, which Mike explained are unfunded liabilities paid from government-borrowed funds, not taxes. By contrast silver and gold are classic hedges against inflation. Their value increases as the purchasing power of the dollar (or any other currency) declines. At the inception of the “American Century”, the name under which the United States gained global economic hegemony through the Bretton Woods Agreement in 1944, an ounce of gold was priced in U.S. dollars at $35/ounce. It’s currently valued at $1,855.50/oz., or 53.01 x the 1944 price. This represents a 5,201% decrease in the purchasing power of the dollar since 1944… and the rate of inflation is increasing rapidly now.

Editor’s Note: In addition to the roughly $31 Trillion U.S. budget deficit, there is an additional estimated $123 Trillion in unfunded U.S. government liabilities, including $55.12 Trillion in unfunded Medicare benefits and $41.2 Trillion in unfunded Social Security benefits now on the books.

One Trillion=1,000 Billion, or 1,000,000 Million. Unfunded liabilities are obligations that the government has promised to pay, for which it has no money. Since the Bretton Woods Agreement the U.S. government has broken its pledge to keep the dollar pegged to gold at $35.00/troy ounce by continually printing more paper dollars to meet it unfunded obligations. This really got out of hand by the early 60s when President Johnson started printing money by the bushel in order to fund his combined programs for prosecution of the Viet Nam war and various social benefit programs, aka “Guns & Butter”. It’s far worse now.

Mark Burling, Mike’s CPA Tax preparer was recalled to the stand by Defense attorney Russell K. Rosenthal, who went over all of the checks that Mike had written out during the tax year in question, but which Mark had not accounted for on the tax return he had prepared for Mike.

On cross-examination by Prosecutor Rachelle DesVaux Bedke, Mark was asked if he recalled Mike questioning him about the losses on the tax return that Mark had prepared [Mike says that he called Mark to ask why his return showed such high losses and didn’t account for all of his income in that year. He says Mark told him that the tax return reflected carry-forward losses from previous years, which explained the losses shown.] Mark responded to Rachelle’s question by saying he did not recall Mike asking him about it and agreed with her that his failure to remember meant the Mike was lying. There was no objection from Defense counsel to this though it was clear that Mark was not a willing defense witness and had a personal need to protect his CPA license, which would be jeopardized had he admitted to preparing a false return.

Wesley Hambley (sp?), the commercial appraiser followed for the defense. He testified that Oasis’ office at 444 Mexico Drive would have appreciated by $900,000 by January 2022 had it not been seized and liquidated. There was no cross-examination.

The Defense’s financial expert came last and was questioned for about 2 hours by Defense counsel Rosenthal. The witness testified that by September 14, 2019, all of Oasis losses would been cleared out by the silver position’s profits on the Forex platform. The expert did very well offering helpful evidence for the defense, but defense counsel did far too little to draw more information from him even though Mike and others had spent nearly 1,000 hours going over every detail of Oasis’ financial records and preparing simplified graphics showing fund flows in and out of the Companies. Without those graphics, the jury was understandably left at a loss to understand key financial details other than the trading losses constantly [mis]reported by the prosecution.

Tuesday 5/3

The Defense Financial Expert continued his testimony from the previous day, but stopped offering unsolicited information if Mr. Rosenthal didn’t ask him for it. NONE of the graphic materials prepared for this part of the trial’s defense was asked for or offered into evidence by Russell Rosenthal. This egregious flaw may prove to be a devastating turning point in the trial.

The Defense then called 3 Lenders to the witness stand: Jason McKee, Kevin Johnson, and John Paniagua, in that order. During cross-examination by the Prosecution, Jason posed an uncomfortable question: “Why” he asked, “did the CFTC not just audit Oasis to find out if it was doing something illegal before seizing the company and liquidating all of its assets?” This question clearly ruffled the Prosecutor who forcefully responded with several questions of his own, such as, “Did you know that the CFTC DID audit the company before fling the complaint?”

There was no objection to this statement from Defense counsel. There should have been because the CFTC had no authority to audit Oasis and if it had, then over the course of the previous 10 days the prosecutors would not have been claiming that Oasis had lost various differing amounts, which seemed to change with every witness. If there had been an authentic audit, then the prosecution would have had a single fixed number for that loss, but they didn’t.

In addition to being a substantial lender, John Paniagua was the software engineer who designed the back office reporting system for Oasis lenders so he was particularly well-informed about financial aspects of the Company operations. He and his brother had spent nearly 700 hours poring over every detail of Oasis’ financial records to produce a clear and easily understood graphic of its fund flows. This was part of the evidence that should have put into the record earlier that morning when the financial expert had testified, but wasn’t because it wasn’t asked for.

John could not have known that the financial witness had not been asked to show the work that had been so carefully prepared to explain the full financial status of Oasis at the time of the government’s shutdown because he wasn’t allowed into the trial room until he appeared as a witness. Since the expert had appeared earlier in the trial, John had no way of knowing what had, or had not, been presented by him.

None-the-less, John did his best to clarify that regardless of the losses accrued on the trading platform he knew that overall Oasis was solvent and always capable of meetings its obligations to its creditors. The Prosecution attempted to force the focus onto the trading losses and refused to acknowledge any other asset the Company had that was able to offset trading losses. As an experienced businessman in his own right, John pushed back by identifying the diverse assets owned by Oasis and explained the risk management model that they represented. At no time was the Company unable to meet it full obligations, despite serious drawdowns in its trading positions.

The last couple hours of this day were given to the attorneys’ closing arguments. Each had 90 minutes, but the prosecution could split its portion into two parts so they could both start the closing argument segment and then follow Defense counsel’s close at the end. They chose to lead off this day with 60 minutes of the Prosecution’s close, leaving 30 minutes to rebut Defense counsel’s close tomorrow. Defense counsel, Sylvia Irvin, used 45 minutes of her time and the day ended.

The Prosecution was given a full 10 days to present its case. The Defense had just 2. The judge will be out at a conference on Thursday and Friday. Defense counsels Adam Allen and Sylvia Irvin leave for well-earned vacations on Saturday and Monday, respectively.

Wednesday 5/4

Defense counsel, Sylvia Irvin, finished her closing argument (45 min), followed by Rachelle DesVaux Bedke who closed for the prosecution (30 min).

The jury was adjourned for deliberation around 10:45 am. They returned after lunch around 2:15 pm with a verdict of guilty on all 3 counts.

Number of | Description of Charge(s) | Disposition |

1 | Attempt and conspiracy fraud | Guilty |

1 | Monetary transactions with property from unlawful act | Guilty |

1 | Fraud and False statements | Guilty |

Week Two: DaCorta Criminal Trial: 4/25-29/2022

May 3, 2022

Monday 4/25

FBI Agent Richard Volp completed his testimony from last Friday and was cross-examined by the Defense. He admitted that Mike’s so-called “confession”, which IRS Agent Batsch submitted 30 days after the two of them had interviewed Mike on April 18, 2019, was falsely reported. Volp’s notes, which were taken that day and from which Batsch wrote his Memorandum of Interview for submission a month later, contradicted what was written – as did the notes taken immediately after the Volp/Batsch interview by Elsie Robinson from the CFTC during her interview of Mike that same morning of the 18th.

Coupled with FBI Agent Stone’s testimony from last week, Agent Volp’s testimony revealed a disturbing willingness of federal agents to falsify reported testimony to make it conform to their own narrative and they’re not above lying in doing so.

Joe Anile, Oasis’ corporate attorney, took the witness stand and openly lied to the Court, telling it that he was not Oasis’ attorney and disavowing that he had anything to do with legal work for the Company. This, of course, was absolutely crazy since the only reason he was given a partnership interest was because of his legal expertise in securities. Anile also told the jury that Mike had admitted to him that he had created a Ponzi scheme to take advantage of the lenders-which would have made him a co-conspirator. The breathtaking brazenness of his lies caught many in the court by surprise, not least his two former partners, Mike DaCorta and Ray Montie, both of whom were sitting there in court bearing witness to the depraved breakdown in character of a man they had formerly trusted with the legal well-being of their company.

Anile pled guilty to criminal charges in 2019. He was convicted at that end of that year, sentenced to 10 years on prison and, pending his appearance for the Prosecution in this, his partner’s trial, was allowed to stay at home. He doesn’t have to report to prison until not sooner than July of this year. He danced to the government’s Hurley Gurley tune in court today, just as they wanted him to.

Tuesday, 4/26

During the conclusion of cross examination by defense attorney Sylvia Irvin, the Court listened to 8-10 phone conversations that Anile had surreptitiously recorded without the awareness or permission of those he was speaking to. These included talks with his partners, Mike DaCorta and Ray Montie, employee Joe Paniagua, and prospective CFO, Joe Calliendo, a friend of Anile’s.

Upon the seizure of Oasis’ properties on April 18, 2019, which was the first time any of them were alerted to the legal challenge Oasis suddenly faced, each of man separately called Oasis Attorney Anile seeking legal advice – which he gave! Sylvia pointed out that Anile was in fact giving legal advice during each of the phone calls and that the calls between him and Mike certainly didn’t seem like those of two Ponzi Scheme co-conspirators as Anile had earlier characterized his relationship with Mike.

Sylvia also showed that Anile had twice taken far more in monthly payments than the $10,000 salary that had been agreed upon for his services. She went into Anile’s bank records and showed illegitimate purchases he and his wife had made out of Oasis bank accounts that were under his sole control. He purchased a Ferrari with stolen corporate funds… but at 6 foot 6 inches and being over 400 pounds, he couldn’t fit in it…shades of O.J. Simpson’s attorney, Johnnie Cochran’s famous reference to the glove – “If it doesn’t fit, you must acquit!”

Throughout her day and half of testimony last week, Deb Cheslow repeatedly referred to Joe Anile as the corporate attorney from whom she received many directives and legal advisories on what could and couldn’t be said or done in her position as Oasis Office Manager. Subsequent testimony and documented evidence submitted by other witnesses on both sides of the argument consistently confirmed that Joe Anile was Oasis Legal Counsel.

A lender from New York, Anthony Charles, appeared for the prosecution, but he seemed to know very little about the Company operations and was probably of little help in clarifying things for the jury. He was hurried off the stand.

Joe Paniagua, who managed correspondence between Oasis and ATC Brokers and corrected entry errors in the back-office records during its beta-testing period, followed Mr. Charles onto the stand. Joe had been subpoenaed by both sides, but here he was appearing as witness for the Prosecution. Joe’s brother, John, was the software engineer that wrote the back-office system, which reported daily earnings for the Lenders.

Wednesday, 4/27

Joe Paniagua continued his direct examination by the prosecution. Joe clarified that the Spotex trade-tracking software contained a customized ledger of loan principal amounts that needed to be adjusted at the end of each month in order to reflect the relative percentage of transaction earnings due to each individual lender under their Promissory Note & Agreement. The end-of-month adjustment to the reference ledger was necessary as new lenders would come in during any given month while established lenders might add-to or subtract-from their own principal amounts during the same month. The principal amount for each lender was squared up before trading started the following month. The Company traded ONLY on its own account as an “eligible contract participant” (ECP), which meant that, according to statute, the CFTC had no jurisdiction over Oasis.

The government wanted (needed) to convince the jury that the ledger proved that Oasis was trading the individual accounts of lenders whereas it was actually only trading its own corporate account and the ledger served no other purpose than to pay proper monthly earnings to each lender under the terms of the Agreement.

On redirect, the infuriated prosecuting attorney, while stamping around the courtroom and pounding papers in a fit of histrionics tried to make the point that the lenders were financially unqualified (non-accredited) U.S. residents and Mike wasn’t allowed to trade for them. She asked if the lenders were accredited ECPs (meaning that if their account was being individually traded, they’d have to have had $10,000,000), but they were not required to be ECPs because Oasis traded its own statutorily-qualified account as the sole ECP.

The reference ledger merely reflected Oasis sub-accounts to the master account that was the only account traded on, and those sub-accounts were NOT held by individual lenders as the government tried to make out. Joe repeatedly refuted the prosecution’s illegitimate characterization, which left the prosecuting attorney steaming since he was supposed be their witness but was of more benefit to the Defense than to Prosecution.

Reporters all noted Joe’s grace and gentlemanly comportment while he endured the verbal assault of the prosecuting attorney on redirect.

Michael Chalhub, a lender and Mike DaCorta’s friend and neighbor, was brought up after Joe Paniagua. Michael also affirmed that he knew that Joe Anile was the Company attorney.

Burton Wiand, the civil court’s receiver, followed and the prosecution started on direct by reviewing his credentials and appointment as receiver. He stated that the case had already been decided by Judge Hernandez-Covington, who is presiding over the civil case, and there was therefore no need for the jury to be seated or the present trial to be held. Actually, the civil case has been administratively stayed since July 2019. Therefore, there has been no discovery, no evidence, no hearing and no trial in that case – the judge could NOT have already decided anything!

Asked if he would return the $2.4M that he’s taken out of the case if Mike is acquitted, he answered “no”. Wiand referred to our Lender Group, which is composed of 67% of the Lenders, as a “small” group of lenders who are obstructing orderly and judicious process in the civil case, but the trial judge would have no part of that conversation.

Thursday, 4/28

The prosecution presented a witness whom they flew in from Chicago. He formerly worked for the National Futures Association (NFA) and is trying to get himself registered with the CFTC. He was presented as an expert. He told the court that the $52M in Oasis’ spread earnings were not revenue to the Company. He mischaracterized the payment of spread revenues as lender money being repaid to them.

Friday, 4/29

IRS Agent Shawn Batsch took the stand in the morning, but his testimony added nothing to the prosecution’s case and made no impression on the court reporters.

After his testimony, the Prosecution finally rested their case after having taken 10 days to present it.

Since the judge announced earlier that he would be absent from the court on Thursday and Friday of next week, thereby cutting off time that the Defense had expected to have for presentation of their case, it will boil down to the Prosecution having been given 10 days and the Defense 2.5.

Mike DaCorta opened as first witness for the defense and was immediately given the opportunity to clarify some of the muddier impressions that had been earlier been created by the Prosecution. Mike had two hours on the stand before the court adjourned for the weekend.

Week 1-Dacorta Criminal Trial: 4/18-22/22

Apr 30, 2022

Monday: 4/18

The case opened with jury selection, which was completed by 1 pm.

The prosecution leads off first by presenting its witnesses, which they will examine one by one on "direct". Mike's defense attorney, Adam Allen, and his staff (Sylvia and Russ) will then "cross" examine each witness. The prosecutors may "redirect" if they feel the need. They exercised this option throughout the first week.

The prosecution opened its case with a 20-minute summation to the jury of the charges it hoped to prove during the trial. The prosecutor simply spoke to the jury without visual or audio aids to help them understand the points being made. It was reportedly very boring.

Mike's defense counsel then gave his summation to the jury, which lasted about 40 minutes, supported by visual aids. It was reportedly a much more lucid and understandable presentation. He concluded by merely stating that "The defense will show that nothing you just heard from the prosecution is true."

The prosecution then proceeded to display to the jury photographs and county registry information on each of the 14 investment properties that Oasis owned. Their witness (Stephen Howland?) was asked to read each of the entries out loud to the jury, making note that Mike was the registered agent for most of the properties. This too was extremely boring for the jury to listen to. The prosecution was trying to leave the impression that Mike owned the properties and had bought them illegally with Oasis funds, but that wasn't true–they were owned by Oasis.

On cross-examination, the "expert" witness was asked if a "registered agent" is necessarily the owner of the listed property and he admitted that they are not. The registered agent for a corporately-owned property like those owned by Oasis is just the person contacted whenever a legal question about the property comes up.

Tuesday: 4/19

The prosecution's second witness, Patti Katter, a lender not in our group, was next up on the witness stand to start the second morning. She gave a rather lifeless, uninspiring, and not very credible account of the loss she experienced after the government’s seizure, but her testimony did nothing to help the prosecution.

Patti was followed by Deborah Oremland, CRD specialist (Central Registration Depository (NASD, Broker-Dealer Registration)). She went back into Mike's records all the way to his elementary schooling and recounted all the licenses he had earned while working on Wall Street. She attested to his success in passing the rigorous exams necessary for that (largely irrelevant) part of his life, but it had little if any bearing on his work in Oasis and merely served to bore the jury further.

Ms. Oremland was replaced on the witness stand by Jennifer Sunu who offered her opinions as an employee of the NFA (National Futures Association). The NFA is a voluntary, self-regulatory organization that works with the CFTC (Commodity Futures Trading Commission) to regulate the futures and commodities markets. One only needs to be a member of it if one is going to operate a business under the jurisdiction of the CFTC. Oasis did not operate under the jurisdiction of the CFTC, so Mike didn’t have to be a member of the NFA.

Jennifer offered her opinion about what a "commodity pool" is but did not accuse Oasis of operating one (as the CFTC repeatedly alleged in its original 886 civil case). Lead defense attorney, Adam Allen, objected several times to this line of conversation and approached the bench 3 times to ask that it be stopped, but the judge allowed it. Adam argued that if the government wasn't going to charge Mike with operating a commodity pool, it should not have been brought up before the jury to provide a platform for the prosecution to make a closing argument on that line. Defense counsel, Russ, cross-examined Jennifer and got her to agree that her interpretation of a commodity pool was open to other interpretations. Sadly, the fact is that the term, "commodity pool", is actually defined by statute - so it's NOT open to interpretation, but that point wasn't made.

Another lender from the Sarasota area, Matt Kihnke, followed Ms. Sunu to the stand. Matt relayed that he had invested $7M and withdrew $6M without any difficulty before the government intervened. The prosecution belabored the jury with boring details of his every deposit and withdrawal, but in the end, his testimony was of no value to either side.

The day ended with former Oasis Office Manager, Deb Cheslow, taking the stand. Her credentials were entered into the record and the day closed.

Wednesday: 4/20

The entire day was given over to Deb Cheslow who offered virtually nothing of any substance to either side, but repeatedly stressed the fact that Joe Anile was the corporate attorney and that she took direction from him in that capacity. She apparently enjoyed the opportunity to pontificate, but all who attended said her testimony didn't seem to clear anything up for the jury.

Thursday: 4/21

Deb Cheslow returned for her finale - and still added little of benefit.

The prosecution played an hour-long taped phone conversation with Oasis prospects, followed by another alternative version from the defense. Dueling perspectives neutralized the prosecution's efforts to convince the jury that the lenders had been deceived during such prospecting phone calls. This gave Adam the opportunity to clarify for the jury that lenders were paid from transaction fees (spread earnings), not from the Company's Profits and Losses-a key point that will have to be reiterated several times before the trial is over.

Joe Anile was expected that day but did not appear.

Instead, undercover FBI Agent Joseph Stone took the stand. Stone had attended the 2018 Christmas party undercover as part of his investigations into Oasis. There he met and ingratiated himself to Lois and Cliff Burnell who subsequently invited him to dinner, seeking to potentially sponsor him into their Ambit business. Stone accepted their invitation and feigned interest in what the Burnells presented, but actually he was covertly videotaping them and trying to obtain evidence against Oasis from their discussion. This devious engagement was brought to light at the trial and on cross-examination Adam asked him if the FBI trained him to deceive people like that or if he adopted the practice on his own. He responded by denying that he deceived people, but when asked what he'd call what he had done, he said "I lie to them." Clearly a distinction without a difference that the jury was sure to pick up on.

By this time in the trial, it was becoming clear to all present that Mike's Defense counsel has a firm hand on the case as he was beginning to shine before the jury with his every appearance on cross-examination.

Friday: 4/22

Friday opened with Christopher Mitchell, a representative from SPOTEX, the software company used by ATC Brokers to track all the trading activities that pass through its operations.

Oasis adapted some SPOTEX software to create a reference table used to allow OIG to pay the promised 25% of monthly transaction fees if they exceeded the alternative 1% amount guaranteed. At the beginning of each month, the reference table had to be reset so that everyone's proper percentage of the potential 25% transaction fee would be proportionally allotted for the next month. Lenders would come in and go out during any given month so the table’s reflection of their proportional contributions had to be reset every month.

The government wants to make the jury believe that the reference table was reset to hide losses, but that was not the case, nor was that its purpose. There is no way to adjust the actual trading record. The government must convince the jury that the individual OIG sub-account numbers in that table were NOT OIG accounts, but instead, Lender accounts being individually traded by the Company. Nothing could be further from the truth, but if they can't make that stick, then the CFTC would have to concede it never had jurisdiction to bring its case against Oasis in the first place because Oasis ONLY traded its own account as a "qualified participant" and under the governing statutes, that means the CFTC did NOT have jurisdiction over it - any more than it would have over car manufacturers like GM, FORD, TOYOTA and every other who trade FOREX constantly to offset potential losses on new car designs being prepared for delivery. Car production can take years from blueprint to delivery, during which time there will be shifts in the relative purchasing power of the currencies those car companies pay and sell in. Thus, they, like Oasis, enter FOREX trades as "qualified participants", trading on their own account, not for individual lenders or shareholders, and not under the jurisdiction of the CFTC, which principally governs retail forex operations - which Oasis was never engaged in.

Mr. Mitchell probably never saw SPOTEX software customized as Oasis had done, so he was understandably confused about the monthly adjustments being made, but again, defense counsel endeavored to clarify for the jury what they needed to know. There will be other opportunities to come to further clarify this essential point as both the prosecution and defense present their witnesses.

FBI Agent Richard Volp followed Mr. Mitchell to the stand and began a long litany of purchases made by Mike at his home address. Mr. Volp, together with IRS Agent Shawn Batsch, first interviewed Mike on the day of the raid on his home, April 18, 2019. He took notes that Batsch later modified and filed into the court 30 days after the interview. These notes seemed to indicate to some that Mike had "confessed", but the notes were later impeached as fraudulently modified in order to make that impression. This point was brought up during Volp's cross-examination - another instance of the FBI using lies and deceit to achieve its own desired results. Videos of the raid on Mike's house were shown. The day ended before Mr. Volp's cross-examination was completed.