News & Views aka The Blog

Registered Users may post comments to the Blog (just sign in and we'll set you up)

Week 3: dacorta criminal trial - May 2-4/2022

May 11, 2022

Monday 5/2

Following up on his opening testimony from Friday, 4/29, Mike DaCorta responded to important questions regarding the prior confused testimony of the government’s witness from Thursday last regarding his Ntl. Futures Assoc. (NFA) settlement agreement and explained why spread earnings are, in fact, revenue – contrary to what the former NFA employee “expert” had stated on 4/28.

Membership in the NFA is voluntary unless a trader needs to be registered with the CFTC. Mike did NOT have to be registered with the CFTC because he ONLY traded the Company account. The companies, OM and OIG, were eligible contract participants (“ECP’s”) as defined in 7 U.S.C. § 1a(18)(A)(v)(III)((aa)-(bb)), thus Mike did not need to register with the CFTC nor be a member of the NFA. None-the-less, the Prosecution hammered on his standing with the NFA subsequent to his settlement agreement. Given the complexity of the statute and the constant belaboring of their illegitimate argument, the jury was probably left with the impression that Mike had been barred from trading.

To rebut the argument that spreads were not revenue just because a profit wasn’t realized from them, Mike used the example of a furniture store owner who purchased a living room couch ensemble for $3,000 wholesale. The owner then promised the party who had loaned him the money to make the purchase that they would be paid $400 whenever the ensemble sold. He placed the furniture on sale for $4,000 but received no offers. After a couple months with no buyer interest, he reduced the price to $3,000; the price he’d paid for it. Still nothing, he further cut the sale price to $2,000, whereupon it was purchased. He entered that sum into his account as revenue, but he still had the promised obligation to pay his lender the agreed-upon $400. That left only $1,600 net from the ensemble he’d paid $3,000 for, but it’s still booked and accounted for as revenue, just as the spread earnings are revenue regardless of the consequences of the trade that followed directly from them being earned. The government has previously acknowledged that Oasis earned $52 million in spread earnings, also known as “transaction fees”.

Every Forex trade involves two traders (a buyer and a seller) and requires each of them to pay a “spread” fee in order to enter their trade. It’s no different than if you pay a $20 cover charge at nightclub door. That money belongs to the nightclub owner, regardless of what happens to you once you enter the place. You might have the time of your life (as in a great Forex trade win), or you might get rolled at the bar (as in losing a Forex trade), but either way the $20 door charge remains as revenue for the club. Just so, the spread fees earned in trading belonged to Oasis and the “expert” was wrong in refusing to identify them ($52 million worth) as revenue for the Company.

Another example that just about everyone has experienced… you buy a ticket to watch a movie. You may or may not enjoy the movie you paid for, but there isn’t a refund regardless. The ticket price is kept by the movie theatre and a portion of it is paid to the distributor who licensed the movie.

On cross examination, Frank Murray for the prosecution brought up various purchases that Mike had made, including the Maserati and a Land Rover Evoque for his daughter. Mike was able to point out that neither car was purchased with Oasis funds and both had 7-year car loans on them. What didn’t get put on the record was that upon seizing the two cars, the Receiver notified the banks that the loans would not be paid, so the banks had to write them off as losses, and then the Receiver “abandoned” both cars rather than sell them as assets of the Receivership Estate. They are now being driven around by Lord only know whom. We have no idea if they were sold or just given away, but no credit for either of them was added to the balance of payments potentially for the benefit of the Lenders or for Oasis should Mike be acquitted, and the civil case dismissed.

Again, on cross, Mike’s daughter’s tuition was brought up by the Prosecution, which allowed Mike to explain that he had paid room and board for his daughter, that she earned scholarships and incurred an education debt of $20,000 for the part of her tuition not otherwise covered.

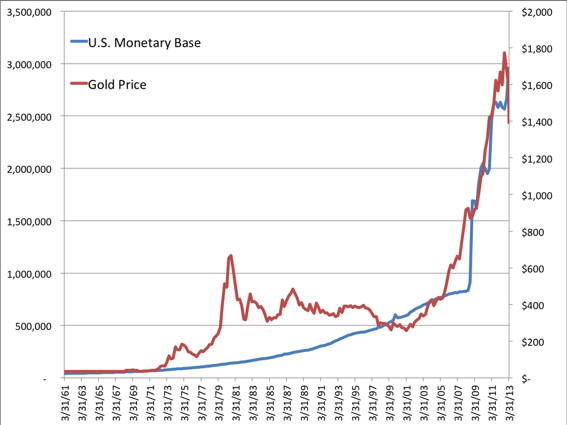

Asked why he bought gold and silver, Mike explained that on October 4th, 2018, the government had lost over $20 trillion in unaccounted funds, so under the Federal Accounting Standards Advisory Board (FASAB) Standard 56 (http://files.fasab.gov/pdffiles/handbook_sffas_56.pdf) it gave itself permission, as Catherine Austin-Fitts explains, “[to] create a set of situations where government entities may move numbers around to conceal where money is actually spent or even not report spending outright.” (See https://constitution.solari.com/fasab-statement-56-understanding-new-government-financial-accounting-loopholes/).

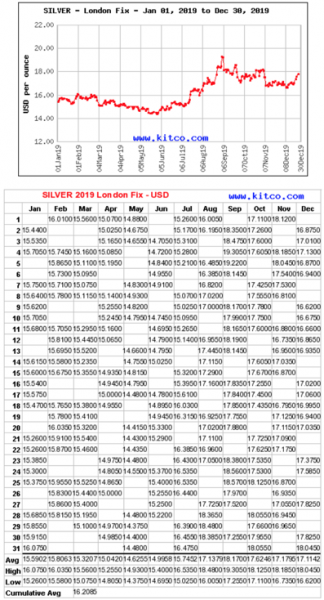

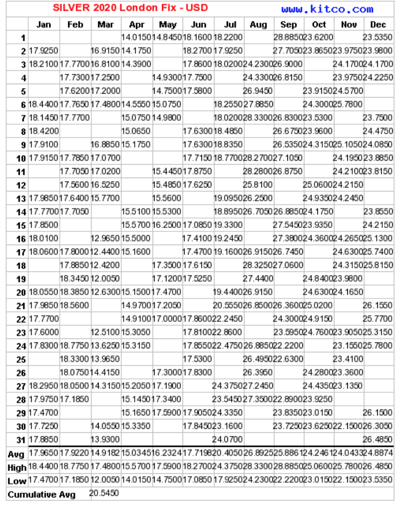

Mike explained that this new standard signaled the United States dollar was on the way to losing its global reserve status (established at Bretton Woods, New Hampshire in 1944-45). That being said, both silver and gold are well positioned to increase in value as the U.S.D. steadily diminishes… and that’s exactly what has happened since Mike purchased the precious metals and opened a 3.8M ounce silver position vs the USD on the Forex trading platform. If the dollar’s purchasing power declines, as will happen if the government keeps printing more of them, then silver’s price will rise.

His own financial expert later confirmed that by September of 2019 the gains in that one position alone would have produced enough profit for Oasis to cover ALL of its outstanding debts–but the Receiver prematurely closed the position at a $3.5M loss instead.

By early autumn 2020, the silver Forex position alone would have earned $60M in profits.

Mike explained that once the debts were covered by his trading position, he would have taken part of the position off the market, paid the debts off and continued from there. Exactly as any good trader would have done.

We’re sure the Prosecution regretted challenging Mike with financial questions, like asking why he hadn’t just deposited funds in a safety deposit box, to which he answered that under the Obama administration’s changed rules and regulations, deposited monies become property of the bank.

Failing to learn from that telling response, the Prosecutor asked him about Social Security and Medicare, which Mike explained are unfunded liabilities paid from government-borrowed funds, not taxes. By contrast silver and gold are classic hedges against inflation. Their value increases as the purchasing power of the dollar (or any other currency) declines. At the inception of the “American Century”, the name under which the United States gained global economic hegemony through the Bretton Woods Agreement in 1944, an ounce of gold was priced in U.S. dollars at $35/ounce. It’s currently valued at $1,855.50/oz., or 53.01 x the 1944 price. This represents a 5,201% decrease in the purchasing power of the dollar since 1944… and the rate of inflation is increasing rapidly now.

Editor’s Note: In addition to the roughly $31 Trillion U.S. budget deficit, there is an additional estimated $123 Trillion in unfunded U.S. government liabilities, including $55.12 Trillion in unfunded Medicare benefits and $41.2 Trillion in unfunded Social Security benefits now on the books.

One Trillion=1,000 Billion, or 1,000,000 Million. Unfunded liabilities are obligations that the government has promised to pay, for which it has no money. Since the Bretton Woods Agreement the U.S. government has broken its pledge to keep the dollar pegged to gold at $35.00/troy ounce by continually printing more paper dollars to meet it unfunded obligations. This really got out of hand by the early 60s when President Johnson started printing money by the bushel in order to fund his combined programs for prosecution of the Viet Nam war and various social benefit programs, aka “Guns & Butter”. It’s far worse now.

Mark Burling, Mike’s CPA Tax preparer was recalled to the stand by Defense attorney Russell K. Rosenthal, who went over all of the checks that Mike had written out during the tax year in question, but which Mark had not accounted for on the tax return he had prepared for Mike.

On cross-examination by Prosecutor Rachelle DesVaux Bedke, Mark was asked if he recalled Mike questioning him about the losses on the tax return that Mark had prepared [Mike says that he called Mark to ask why his return showed such high losses and didn’t account for all of his income in that year. He says Mark told him that the tax return reflected carry-forward losses from previous years, which explained the losses shown.] Mark responded to Rachelle’s question by saying he did not recall Mike asking him about it and agreed with her that his failure to remember meant the Mike was lying. There was no objection from Defense counsel to this though it was clear that Mark was not a willing defense witness and had a personal need to protect his CPA license, which would be jeopardized had he admitted to preparing a false return.

Wesley Hambley (sp?), the commercial appraiser followed for the defense. He testified that Oasis’ office at 444 Mexico Drive would have appreciated by $900,000 by January 2022 had it not been seized and liquidated. There was no cross-examination.

The Defense’s financial expert came last and was questioned for about 2 hours by Defense counsel Rosenthal. The witness testified that by September 14, 2019, all of Oasis losses would been cleared out by the silver position’s profits on the Forex platform. The expert did very well offering helpful evidence for the defense, but defense counsel did far too little to draw more information from him even though Mike and others had spent nearly 1,000 hours going over every detail of Oasis’ financial records and preparing simplified graphics showing fund flows in and out of the Companies. Without those graphics, the jury was understandably left at a loss to understand key financial details other than the trading losses constantly [mis]reported by the prosecution.

Tuesday 5/3

The Defense Financial Expert continued his testimony from the previous day, but stopped offering unsolicited information if Mr. Rosenthal didn’t ask him for it. NONE of the graphic materials prepared for this part of the trial’s defense was asked for or offered into evidence by Russell Rosenthal. This egregious flaw may prove to be a devastating turning point in the trial.

The Defense then called 3 Lenders to the witness stand: Jason McKee, Kevin Johnson, and John Paniagua, in that order. During cross-examination by the Prosecution, Jason posed an uncomfortable question: “Why” he asked, “did the CFTC not just audit Oasis to find out if it was doing something illegal before seizing the company and liquidating all of its assets?” This question clearly ruffled the Prosecutor who forcefully responded with several questions of his own, such as, “Did you know that the CFTC DID audit the company before fling the complaint?”

There was no objection to this statement from Defense counsel. There should have been because the CFTC had no authority to audit Oasis and if it had, then over the course of the previous 10 days the prosecutors would not have been claiming that Oasis had lost various differing amounts, which seemed to change with every witness. If there had been an authentic audit, then the prosecution would have had a single fixed number for that loss, but they didn’t.

In addition to being a substantial lender, John Paniagua was the software engineer who designed the back office reporting system for Oasis lenders so he was particularly well-informed about financial aspects of the Company operations. He and his brother had spent nearly 700 hours poring over every detail of Oasis’ financial records to produce a clear and easily understood graphic of its fund flows. This was part of the evidence that should have put into the record earlier that morning when the financial expert had testified, but wasn’t because it wasn’t asked for.

John could not have known that the financial witness had not been asked to show the work that had been so carefully prepared to explain the full financial status of Oasis at the time of the government’s shutdown because he wasn’t allowed into the trial room until he appeared as a witness. Since the expert had appeared earlier in the trial, John had no way of knowing what had, or had not, been presented by him.

None-the-less, John did his best to clarify that regardless of the losses accrued on the trading platform he knew that overall Oasis was solvent and always capable of meetings its obligations to its creditors. The Prosecution attempted to force the focus onto the trading losses and refused to acknowledge any other asset the Company had that was able to offset trading losses. As an experienced businessman in his own right, John pushed back by identifying the diverse assets owned by Oasis and explained the risk management model that they represented. At no time was the Company unable to meet it full obligations, despite serious drawdowns in its trading positions.

The last couple hours of this day were given to the attorneys’ closing arguments. Each had 90 minutes, but the prosecution could split its portion into two parts so they could both start the closing argument segment and then follow Defense counsel’s close at the end. They chose to lead off this day with 60 minutes of the Prosecution’s close, leaving 30 minutes to rebut Defense counsel’s close tomorrow. Defense counsel, Sylvia Irvin, used 45 minutes of her time and the day ended.

The Prosecution was given a full 10 days to present its case. The Defense had just 2. The judge will be out at a conference on Thursday and Friday. Defense counsels Adam Allen and Sylvia Irvin leave for well-earned vacations on Saturday and Monday, respectively.

Wednesday 5/4

Defense counsel, Sylvia Irvin, finished her closing argument (45 min), followed by Rachelle DesVaux Bedke who closed for the prosecution (30 min).

The jury was adjourned for deliberation around 10:45 am. They returned after lunch around 2:15 pm with a verdict of guilty on all 3 counts.

Number of | Description of Charge(s) | Disposition |

1 | Attempt and conspiracy fraud | Guilty |

1 | Monetary transactions with property from unlawful act | Guilty |

1 | Fraud and False statements | Guilty |